what is suta tax california

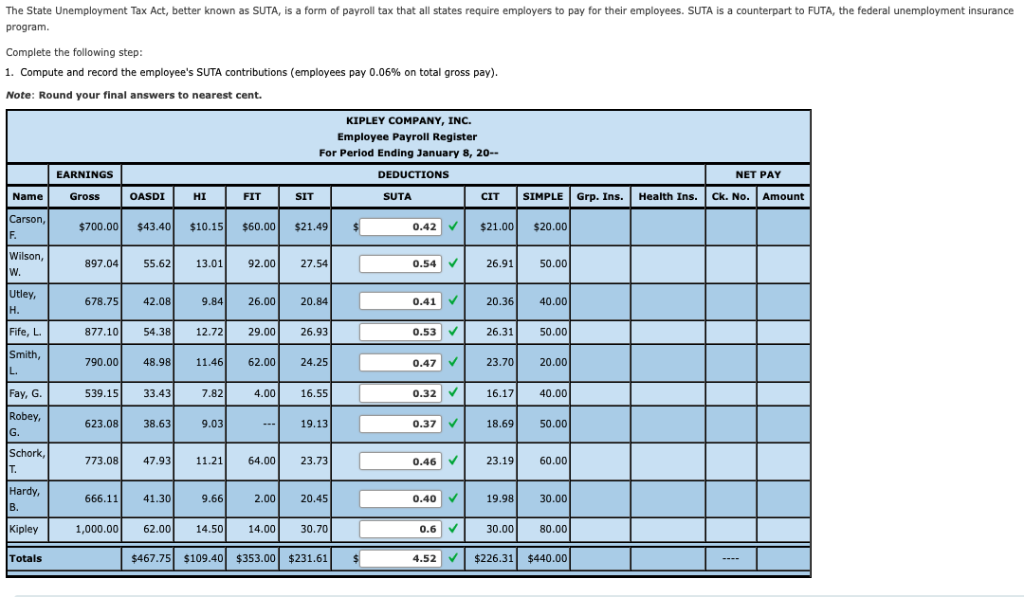

5 of 7000 350. Your taxable wage base per employee.

Nanny Payroll Part 3 Unemployment Taxes

Some areas may have more than one district tax in effect.

. See Determining Unemployment Tax Coverage. Each state typically has a range of SUTA rates eg 065 68 in Alabama. If youve been an employer for a while i.

Since your business has no. Each state usually has a standard SUTA tax rate for new employers. 52 rows SUTA the State Unemployment Tax Act is the state unemployment.

What is California tax rate for payroll. SUTA tax is experience rated which means that tax rates for a company reflect the cost of the benefits that the companys former employees have received. How to calculate the SUTA tax.

SUTA State Unemployment Tax Act dumping one of the biggest issues facing the Unemployment Insurance UI program is a tax evasion scheme where shell companies are formed and creatively manipulated to obtain low UI tax rates. State Disability Insurance SDI and Personal Income Tax PIT are withheld from employees wages. For the majority of states SUTA tax is an employer-only tax.

States use funds from SUTA tax to pay unemployment benefits to unemployed workers. States use funds from SUTA tax to pay unemployment benefits to unemployed workers. In most areas of California local jurisdictions have added district taxes that increase the tax owed by a seller.

These amounts vary by state and theyre subject to change. The SUI rate schedule is expected to remain F for the foreseeable future. Tax-rated employers pay a percentage on the first 7000 in wages paid to each employee in a calendar year.

Your tax rate might be based on factors like your industry how many former employees received unemployment benefits and experience. Sellers are required to report and pay the applicable district taxes for their taxable. The statewide tax rate is 725.

California law defines wages for state unemployment insurance SUI purposes as all compensation paid for an employees personal services whether paid by check or cash or the. The SDI withholding rate for 2022 is 110 percent. Transmittal of Wage and Tax Statements Form W-3 1.

The money collected through SUTA tax funds the state unemployment insurance to employees who lost their job through no fault of their own. The State Unemployment Tax Act SUTA is a state version of the FUTA tax. The states SUTA wage base is 7000 per employee.

To calculate your SUTA tax payments you need to know two things. California has four state payroll taxes. Unlike the FUTA tax with a single federal regulation SUTAs that employers must comply with vary by.

Star Tax Solutions is primarily engaged in Tax Preparation Services If your looking for Tax Preparation Services in Irvine California -. Your state unemployment tax rate. Find information on Star Tax Solutions including this business SIC codes NAICS codes and General Liabilility Class codes.

As a result of the ratio of the California UI Trust Fund and the total wages paid by all employers continuing to fall below 06 the 2021 SUI tax rates continue to include a 15 surcharge. For example if you have eight employees and you pay all of them at least 45000 per year you only need to pay the FUTA tax rate on 56000 total eight employees multiplied by the 7000 FUTA cap. Under FUTA f ederal unemployment tax rates are six percent taken on each of your employees first 7000 in wages.

Unemployment Insurance UI and Employment Training Tax ETT are employer contributions. The State Unemployment Tax Act SUTA tax also called SUI state unemployment insurance or reemployment tax is a type of payroll tax that employers must pay to the state. Employer Contributions Most employers are tax-rated employers and pay UI taxes based on their UI rate.

The tax rate is set by statute at 01 percent 001 of UI taxable wages for the employers with positive UI reserve account balances and employers subject to Section 977 c of the California Unemployment Insurance Code. This means that instead of funding the federal governments unemployment and benefits programs employers will be paying the state government to fund unemployment insurance programs. FICA tax is a 62 Social Security tax and 145 Medicare tax on earnings.

SUTA is a tax paid by employers at the state level to fund their states unemployment insurance. For the majority of states SUTA tax is an employer-only tax. The SDI withholding rate is the same for all employees and is calculated annually.

Those district tax rates range from 010 to 100. The State Unemployment Tax Act SUTA tax also called SUI state unemployment insurance or reemployment tax is a type of payroll tax that employers must pay to the state. SUTA tax rates vary depending on the state your business is in or the state your employees work if different.

However the money collected from the FUTA tax funds the federal governments oversight of each states individual unemployment insurance program. California state tax rates are 1 2 4 6 8 93 103 113 and 123. When a low rate is obtained payroll from another entity with a high UI tax rate is shifted to the account with the lower rate.

FUTA or Federal Unemployment Tax is a similar tax thats also paid by all employers. The new employer SUI tax rate remains at 34 for 2021. Employers in California are subject to a SUTA rate between 15 and 62 and new non-construction businesses pay 34.

FICA tax is a 62 Social Security tax and 145 Medicare tax on earnings. Employers in California are subject to a SUTA rate between 15 and. A 1 mental health services tax applies to income exceeding 1 million.

Employers in California are subject to a SUTA rate between 15 and 62 and new non-construction businesses pay 34. California state tax brackets and income. California uses the Dynamex ABC Test to determine whether a worker is an employee for purposes of unemployment tax coverage.

Employers in California are subject to a SUTA rate between 15 and 62 and new non-construction businesses pay 34.

How To Fill Out Irs Form 940 Futa Tax Return Youtube

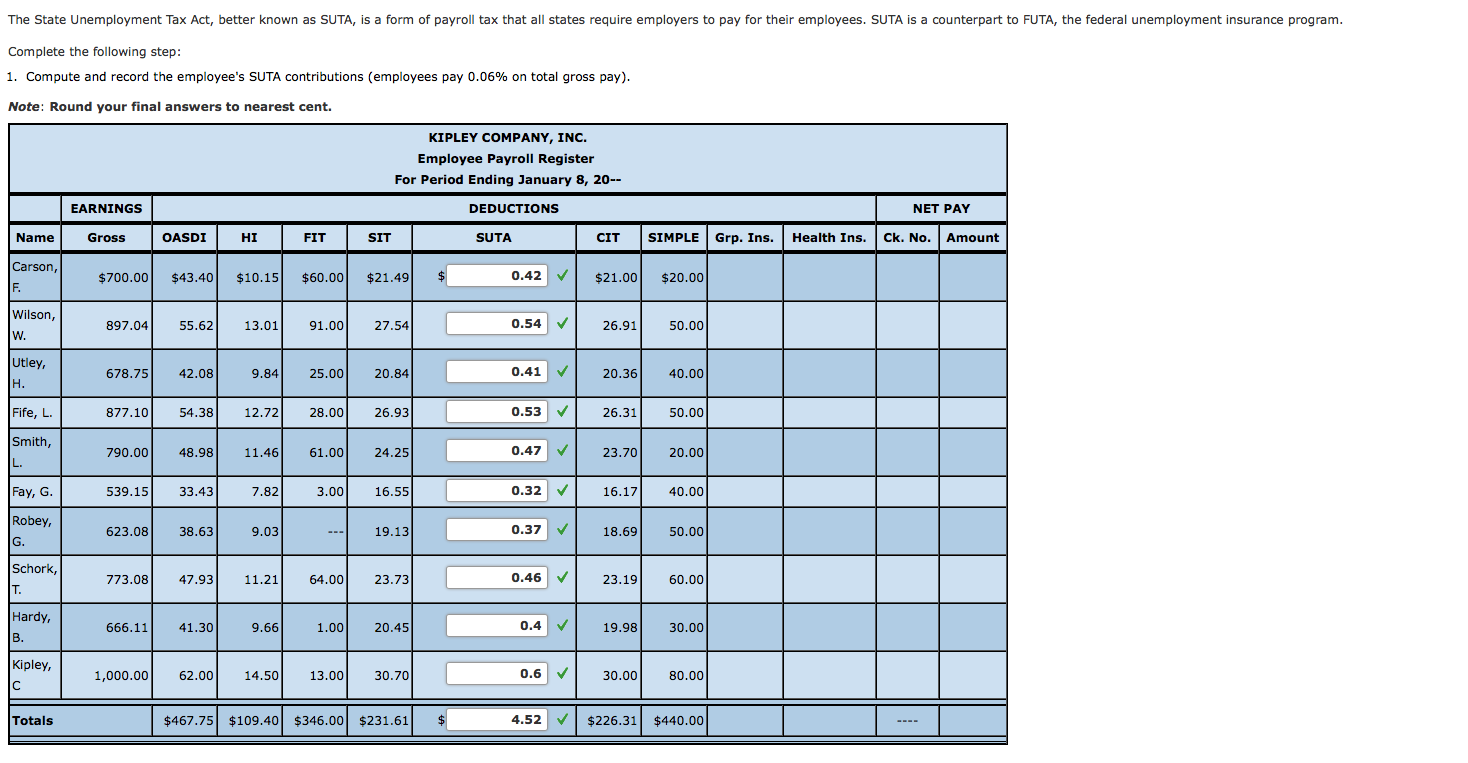

Solved The State Unemployment Tax Act Better Known As Suta Chegg Com

How To Reduce Your Clients Suta Tax Rate In 2014 Cpa Practice Advisor

What Is Sui State Unemployment Insurance Tax Ask Gusto

Sample Financial Budget Business Budget Template Financial Plan Template Financial Budget

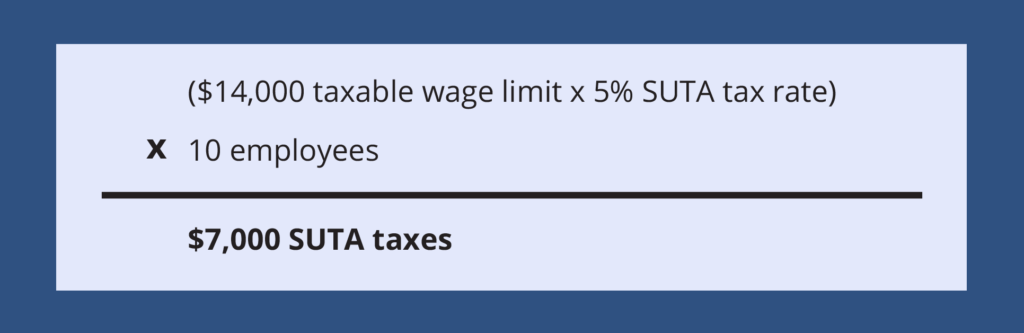

What Is The Futa Tax 2022 Tax Rates And Info Onpay

Breaking Down The Federal Unemployment Tax Act What Is It

State Unemployment Tax Ballotpedia

Futa Tax Overview How It Works How To Calculate

Solved The State Unemployment Tax Act Better Known As Suta Chegg Com

The True Cost Of Hiring An Employee In California Hiring True Cost California

Chapter 11 1 Chapter 11 Current Liabilities And

2022 Federal Payroll Tax Rates Abacus Payroll

What S The Cost Of Unemployment Insurance To The Employer

Sample Financial Budget Plan Business Budget Template Financial Plan Template Financial Budget

Solved The State Unemployment Tax Act Better Known As Suta Chegg Com

Ultimate Guide To Sui And State Unemployment Tax Attendancebot